The 100 Percent Tariff Ultimatum has officially moved from a campaign threat to a defining pillar of international commerce in 2026. This policy has fundamentally redefined how goods flow between the East and the West, creating a tectonic shift in the global trade landscape. For sourcing professionals and global economists, the “China plus one” strategy is no longer a suggestion—it is a survival mechanism.

The 100 Percent Tariff Ultimatum: A Line in the Sand for the Dollar

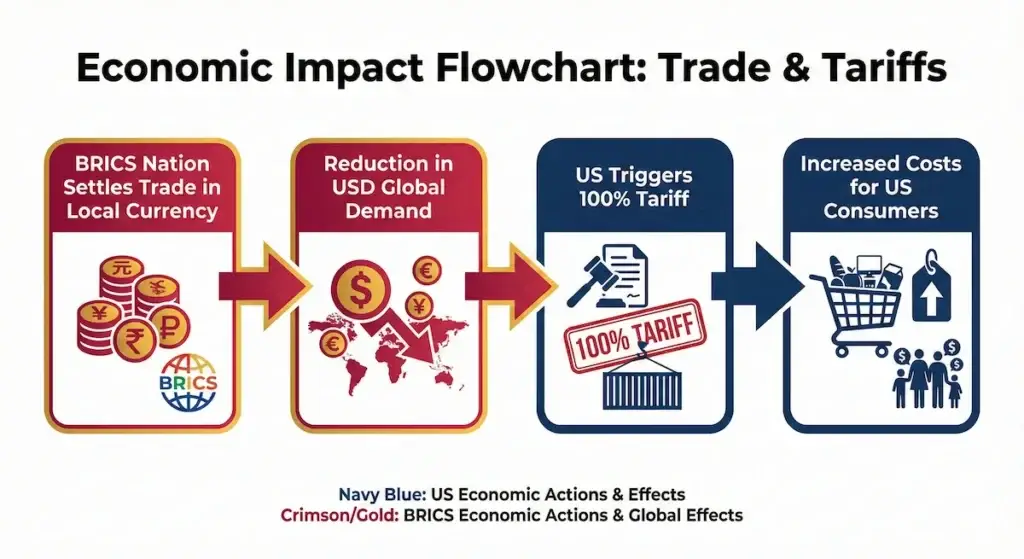

In the final months of 2024 and throughout early 2025, the U.S. administration issued a declaration that sent shockwaves through the G20: Any nation attempting to bypass the U.S. dollar in international trade or participating in the creation of a “BRICS Currency” would face an immediate 100% tariff on all exports to the United States.

This was not just a tax on steel or consumer electronics; it was a total economic blockade aimed at preserving the “Greenback Hegemony.” For nearly 80 years, the U.S. dollar has served as the world’s primary reserve currency, used in nearly 90% of global foreign exchange transactions. The ultimatum was designed to stop the bleeding of the dollar’s market share, which had slowly eroded from 72% in 2000 to below 58% by 2024.

The geopolitical weight of the 100 Percent Tariff Ultimatum cannot be overstated, as it represents the most aggressive use of trade policy to defend a currency in modern history. Unlike previous administrative actions that targeted specific commodities, the 100 Percent Tariff Ultimatum is a blanket measure designed to force a binary choice upon global partners: either remain within the dollar-based financial ecosystem or lose access to the world’s most lucrative consumer market. This all-encompassing nature is what distinguishes this policy from the selective trade skirmishes of the past decade.

De-Dollarization: Myth vs. Reality in 2026

While the threat of 100% tariffs initially caused a diplomatic retreat, the reality on the ground is more nuanced. De-dollarization in 2026 isn’t about a single “gold-backed BRICS coin.” Instead, it is a fragmentation. We are seeing a “local currency revolution.” In 2025, trade between China and Russia reached record levels, with over 90% of it settled in Yuan and Rubles. India has successfully settled oil trades with the UAE in Rupees, and Saudi Arabia has signaled a willingness to price crude in non-dollar currencies.

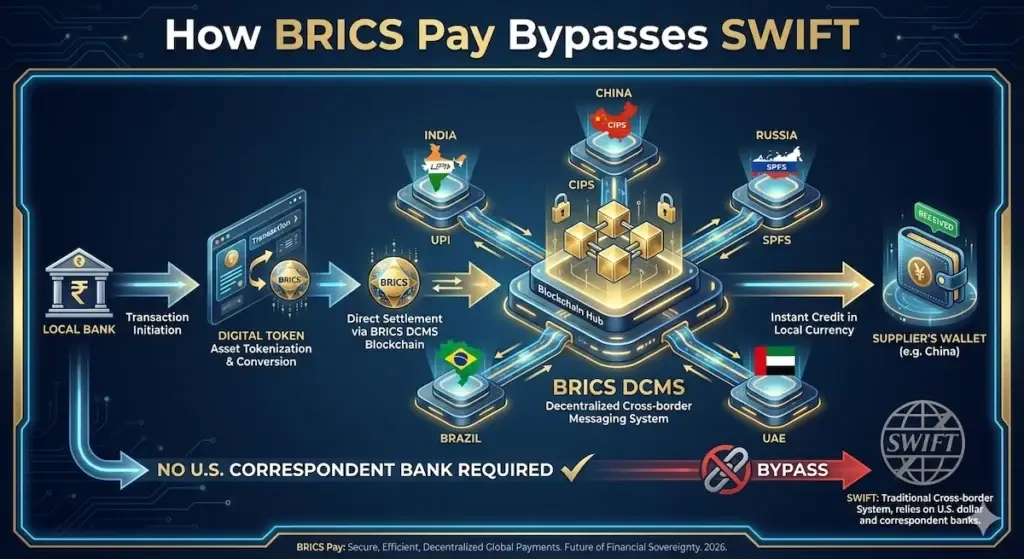

This shift is facilitated by BRICS Pay, a decentralized blockchain-based messaging system. Unlike SWIFT, which the U.S. can use as a financial weapon, BRICS Pay allows nations to conduct peer-to-peer trade without ever touching a U.S. correspondent bank.

| Economic Indicator | 2024 Status | 2026 Realities (Post-Ultimatum) |

| USD Share of Reserves | 58% | 53% (Historical Low) |

| Yuan Trade Settlement | 6.1% | 11.5% |

| US Consumer Price Index | 2.8% | 4.4% (Direct Tariff Impact) |

| Global Gold Reserves | 35,000 Tons | 39,200 Tons (Aggressive Hedging) |

The Economic Fallout: A Double-Edged Sword

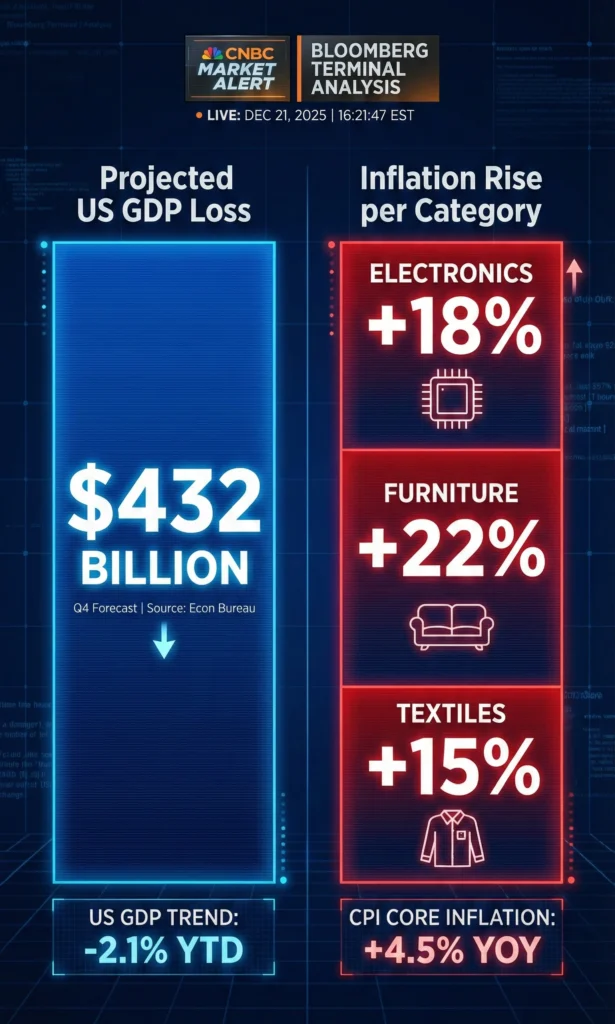

The Peterson Institute for International Economics (PIIE) projected that a 100% tariff on BRICS+ nations would result in a $432 billion hit to U.S. GDP. While the policy was intended to protect the dollar, it has simultaneously ignited imported inflation.

This $432 billion contraction is not just a theoretical loss of growth; it represents a fundamental repricing of the American middle-class lifestyle. Analysis from the Budget Lab at Yale suggests that by mid-2026, core goods prices have already broken with a decade of stability. Household appliances have seen a 3.9% price spike above prior trends, while furniture and decorative home goods have surged by 3.1%. For the sourcing professional, these are the early warning signs of a “Margin Squeeze” where the cost of goods sold (COGS) is rising faster than retail price elasticity can handle. The administration’s gamble is that this short-term pain will be offset by the long-term repatriation of industrial capacity, but for 2026, the primary result is a massive transfer of wealth from consumers to the U.S. Treasury in the form of customs duties.

For sourcing partners, the logistics have become a challenge. A product manufactured in a BRICS nation that used to land in the U.S. for a competitive price now faces a 100% duty, making it difficult to sell at retail. This has led to the “Great Reroute.”

For procurement officers in Hong Kong and beyond, the 100 Percent Tariff Ultimatum has introduced an unprecedented level of “Political Risk Premium” into every contract. When calculating the landed cost of goods, businesses must now factor in the possibility that a sudden enforcement of the 100 Percent Tariff Ultimatum could overnight double their tax liability at the port of entry. This uncertainty is forcing a radical shift toward shorter contract durations and more localized supply chains.

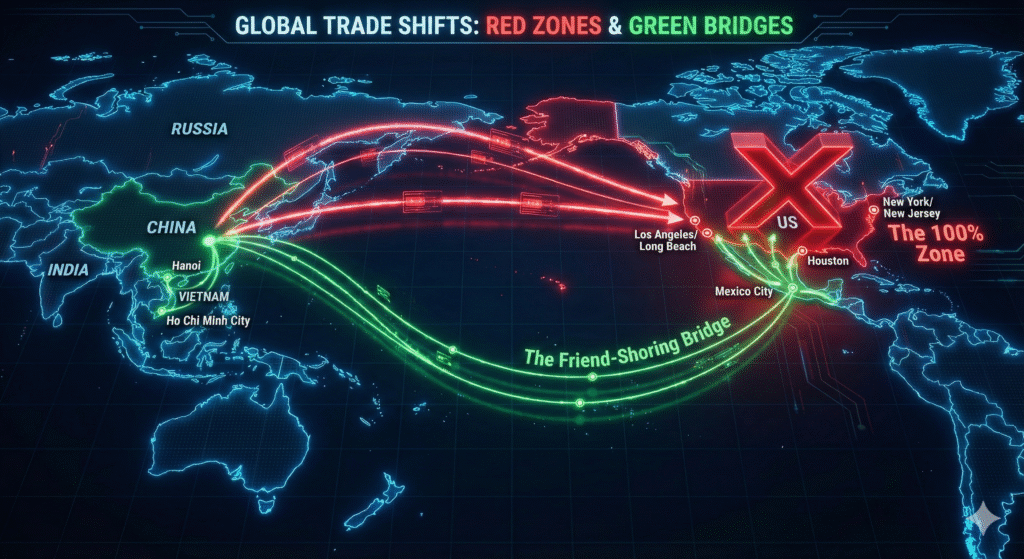

The “Friend-Shoring” Pivot

To survive, manufacturers are fleeing the “100% Zone.” In 2025 and 2026, we saw a massive surge in Foreign Direct Investment (FDI) into Vietnam, Mexico, and Thailand. However, the U.S. Department of Commerce has countered with “Secondary Audits.” If a product is largely made in a BRICS nation but only “assembled” in a third country to avoid the tariff, it is often flagged for transshipment fraud. This has created a new industry of supply chain compliance and forensic origin audits.

Why 100%? The Psychology of the Ultimatum

The 100% figure is psychological. Most trade wars are fought in the 10% to 25% range. A 100% tariff is not a negotiation; it is an eviction notice. It signals to the world that the U.S. is willing to trade a portion of its GDP growth for the long-term survival of the dollar’s status.

In a direct warning to BRICS leadership, the administration stated that nations attempting to undermine the dollar should expect to say goodbye to selling into the wonderful U.S. Economy. For the U.S. Treasury, the 100% tariff is a “War Footing” measure to prevent a total collapse of the federal borrowing system. The message concluded with a stark ultimatum: any country that tries to replace the dollar should say hello to Tariffs, and goodbye to America!

Strategic Advice: Navigating the 2026 Trade War

For global businesses, the era of easy sourcing is over. We are entering a Bi-Polar Trade World. To remain competitive, companies must adopt a three-pronged strategy:

- Origin Diversification: Establish manufacturing hubs in non-BRICS nations that maintain “Most Favored Nation” status with the U.S.

- Currency Hedging: As the Yuan and Rupee gain ground, holding local currency accounts for trade settlements is becoming a standard hedge against dollar volatility.

- Digital Supply Chains: Utilize AI and blockchain to provide 100% transparency in the “Country of Origin” for every component, ensuring compliance with secondary tariff regulations.

Conclusion: The New Multipolar Reality

The 100% Tariff Ultimatum has achieved its goal of creating a pause in BRICS+ expansion, but it has not stopped the momentum of de-dollarization. Instead, it has accelerated the development of alternative financial systems that are now “hardened” against traditional sanctions.

Ultimately, the success of the 100 Percent Tariff Ultimatum will be measured by its ability to stall the momentum of de-dollarization without triggering a global depression. If the 100 Percent Tariff Ultimatum leads to a permanent splintering of global trade, the costs of compliance will become a permanent fixture of the new economic order. Whether this serves as a final defense of the greenback or the catalyst for its replacement remains the most critical question of 2026.

As we move into 2027, the world will likely be split into two distinct economic spheres. One will remain anchored to the U.S. Dollar, and the other will operate in a decentralized, local-currency-based network. For the trade professional, the challenge is no longer just finding the best price—it’s navigating the most stable geopolitical path.