As we close out 2025, the electric vehicle (EV) has transformed from a symbol of green energy into the primary chess piece in a high-stakes game of global trade. From Washington to Brussels, and Beijing to New Delhi, governments are rewriting the rules of the road. For businesses and consumers alike, understanding these shifts is no longer optional—it is essential.

In this inaugural “Product Focus” deep dive, we look at how tariffs, trade barriers, and localization policies are reshaping the global EV market.

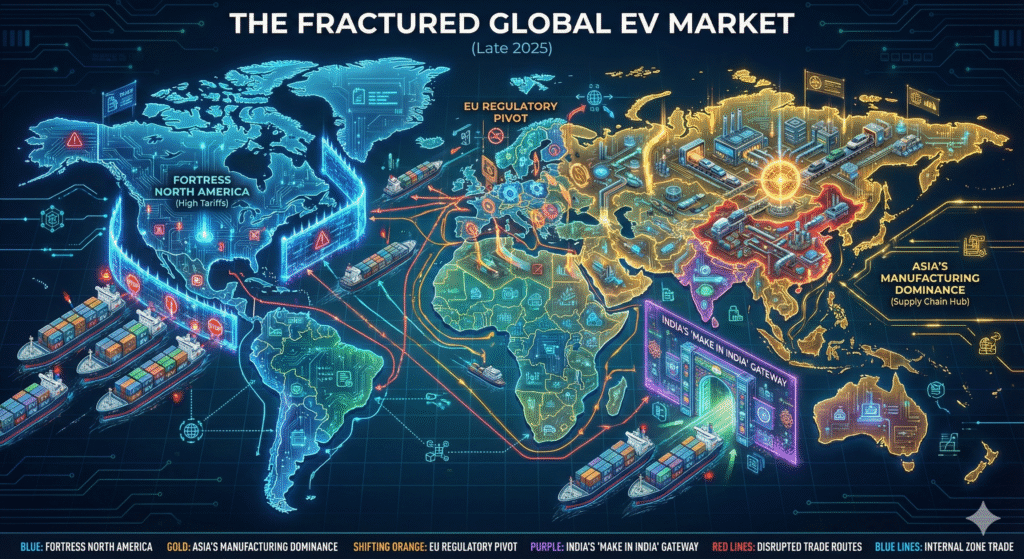

The Global EV Trade War: A Fragmented Market

For years, the dream of the electric transition was a globalized one: batteries made in Asia, assembled in global hubs, and sold to drivers everywhere. That dream has hit a wall of reality. We are now seeing the emergence of a fragmented market where “where it’s made” matters just as much as “how it drives.”

The driving force behind this fragmentation is a fundamental disagreement on fair trade. Western nations argue that state subsidies have created an uneven playing field, leading to an overcapacity of affordable EVs flooding the market. In contrast, manufacturing powerhouses argue that their competitive pricing is simply the result of efficient supply chains and early investment in technology.

Europe’s Strategic Pivot

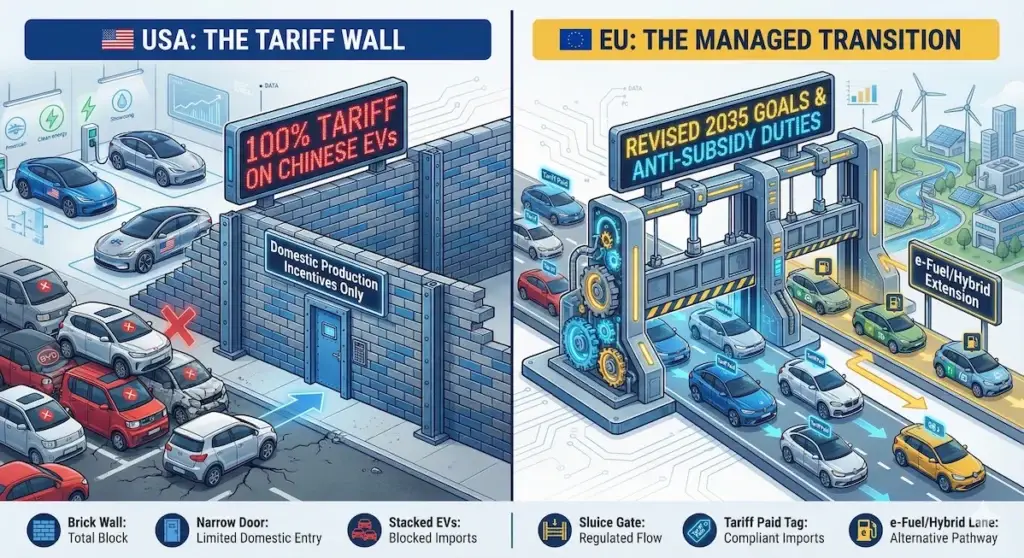

Perhaps the most significant development of late 2025 has come from the European Union. For years, the EU was the world’s most aggressive champion of a full transition to electric mobility. However, the reality of industrial economics has forced a pragmatic retreat.

Just this week, reports confirmed that the EU is moving to soften its landmark 2035 ban on internal combustion engines. Facing immense pressure from its domestic auto sector, policymakers are pivoting to a “managed transition.” The new proposal reportedly replaces the 100% emissions cut target with a 90% reduction target, effectively allowing hybrids and vehicles running on e-fuels to stay on the road longer than anticipated.

This domestic policy shift is paired with a hardening trade stance, a defining feature of the Global EV Trade War. The tariffs imposed on Chinese EV imports—which sparked debates on climate goals versus industrial protection—were designed to level the playing field. Yet, exporters have adapted quickly, shipping partially assembled kits to be finished within EU borders or absorbing tariff costs to maintain market share.

The Fortress North America

Across the Atlantic, the United States has taken an even more defensive posture, escalating the Global EV Trade War. The strategy, solidified by the Biden administration’s decision in May 2024 to quadruple tariffs on Chinese EVs to 100%, has created a “Fortress North America.”

The US strategy is two-pronged:

- High Barriers to Entry: The 100% tariff rate effectively ring-fences the American market. This creates a safe harbor for domestic manufacturers but limits consumer choice compared to Europe or Asia.

- The Battery Belt: The incentives for manufacturing on US soil remain strong. We are seeing a massive reshuffling of supply chains as companies race to source lithium and nickel from “friendly” nations to qualify for tax credits.

However, this protectionism comes at a price. While it safeguards domestic industry, it keeps the price of EVs significantly higher than in Asian markets, slowing mass adoption.

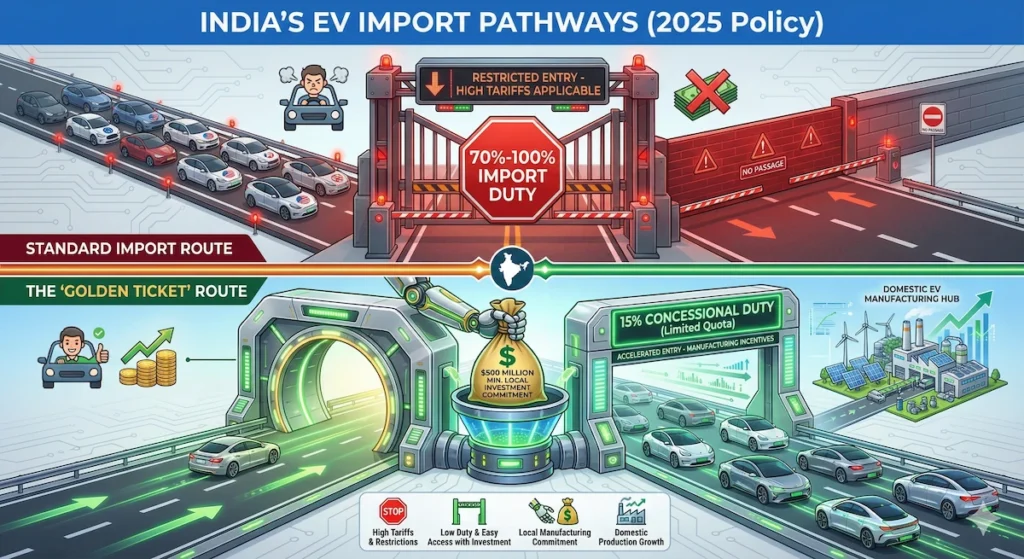

India’s “Make in India” Gamble

While major players in the Global EV Trade War builds walls, India is trying to build bridges—but with a toll.

India has long been known for its notoriously high import duties on luxury cars. However, the government recently introduced a landmark EV policy offering a “golden ticket”: a dramatically reduced import duty of just 15% for global EV makers.

The catch? Commitment. To qualify, manufacturers must invest a minimum of $500 million (approx. ₹4,150 crore) and commit to setting up local manufacturing plants within three years. This policy has already attracted interest from major global players looking to diversify beyond China, effectively using India as a new export hub.

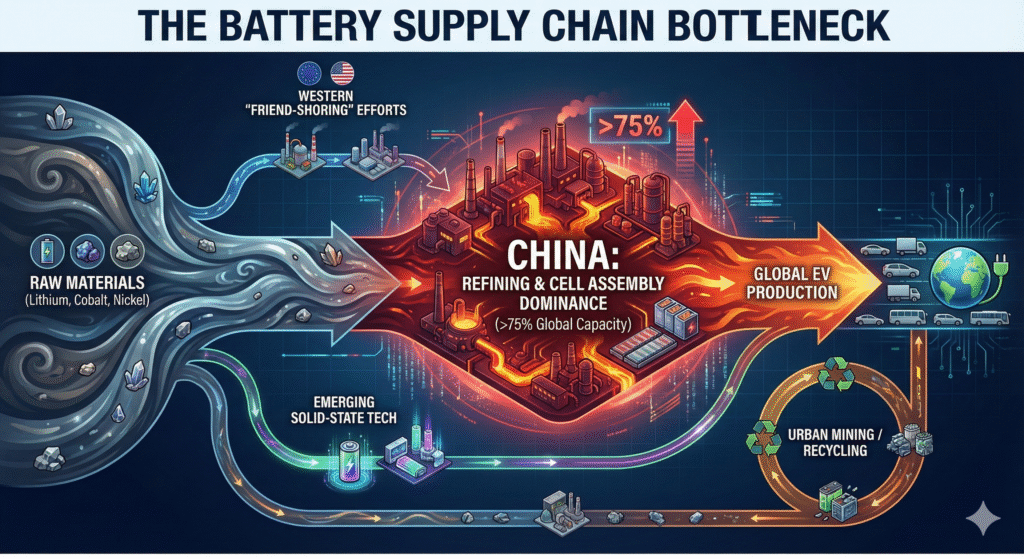

The Product Focus: Batteries are the New Oil

You cannot discuss EVs without discussing the product that makes them move: the battery. In this trade war, the battery is not just a component; it is the ammunition. The reason global trade barriers are so complex is that the supply chain for batteries is incredibly deep, and right now, it is fighting a war on two fronts: Geopolitics and Chemistry.

The Chemistry Divide: LFP vs. NMC The trade war is actually driving a technological split in what kind of batteries cars use.

- China’s LFP Dominance: Chinese manufacturers have bet big on Lithium Iron Phosphate (LFP) batteries. These contain no cobalt or nickel, making them significantly cheaper and safer, though with slightly less range. Because China controls the vast majority of the LFP supply chain, Western tariffs are essentially trying to block this specific affordable technology from undercutting their markets.

- The West’s Nickel Gamble: In contrast, US and European automakers have historically focused on NMC (Nickel Manganese Cobalt) batteries. These offer longer range but are more expensive and rely on volatile materials like Cobalt. The trade barriers are effectively forcing Western consumers to pay a premium for this “performance” chemistry because the cheaper LFP alternative is being taxed out of the market.

The Supply Chain Choke Points

- Refining Capacity: Even if a US company mines lithium in Nevada, it often has to ship that rock to China to be refined into battery-grade material, then ship it back. China currently controls over 70% of the world’s lithium refining. Decoupling this loop is the single biggest challenge for Western “friend-shoring” policies.

- The Leapfrog Tech: We are seeing a desperate race for “Solid-State” Batteries. Companies like Toyota and US-based QuantumScape are trying to commercialize this tech by 2027-2028. The geopolitical hope is that by achieving a breakthrough in next-gen battery tech, the West can “reset the board” and render China’s current dominance in liquid-electrolyte batteries obsolete.

- Recycling as a Resource: With trade barriers rising, “urban mining” (recycling old batteries) is becoming a critical industry. If you cannot import the lithium cheaply, you have to recover it from old electronics. This has turned recycling plants into strategic national assets.

What This Means for Business: A New Playbook

For those of you navigating the complexities of the Global EV Trade War —whether you export furniture, electronics, or raw materials—the EV sector serves as the “canary in the coal mine” for the wider economy. The trends we see here are spreading to robotics, renewable energy hardware, and even consumer tech.

If you are sourcing or exporting in this new climate, the “Just-in-Time” efficiency model is dead. The new model is “Just-in-Case.”

1. The “China Plus One” Reality Reliance on a single source country is now a liability. We are seeing a massive shift where businesses maintain their primary manufacturing in China for efficiency, but establish a secondary “shadow” supply chain in nations with favorable trade treaties.

- For US Markets: Look to Mexico. The USMCA agreement allows for duty-free entry if specific “Rules of Origin” are met.

- For EU Markets: Look to Eastern Europe (Hungary, Poland) or Turkey, which serve as the industrial backyards for the EU auto sector.

- For Global Markets: Vietnam and India are rapidly becoming the preferred alternatives for electronics and assembly, though their infrastructure still lags behind China’s.

2. Regulatory Agility is a Skill Tariff codes (HS Codes) are changing monthly. A product classified as a “motor part” today might be reclassified as a “strategic electronic component” tomorrow, triggering a 25% duty. Successful exporters in 2026 will be those who audit their HS codes quarterly and maintain close relationships with customs brokers who understand the political winds.

3. The Rise of “Kit Assembly” (CKD/SKD) The days of purely exporting finished goods (CBUs) are fading for high-value items. To bypass tariffs, we are seeing a return to CKD (Completely Knocked Down) and SKD (Semi-Knocked Down) exports. This involves shipping a product in parts to the destination country and assembling it locally using a small workforce. This often allows the product to be labeled “Made in [Destination Country],” bypassing the steepest duties.

Conclusion

At the heart of the Global EV Trade War lies a paradox: the vehicle supposed to save the planet has become political pawn. The electric vehicle was supposed to save the planet. Along the way, it became the prize in a global economic wrestling match. While the road ahead is filled with toll booths and checkpoints, the destination remains the same: a cleaner, electrified future. The only question that remains is: who will be in the driver’s seat?

Pingback: China-Australia Trade: A Strategic 2026 Deep Dive