Shenzhen AI Robotics is rapidly transforming the “World’s Factory” from a hub of manual assembly lines to a center of embodied intelligence.If you walked through the Huaqiangbei Electronics Market in 2015, the air buzzed with the sound of drones. If you walk through the Nanshan Science and Technology Park today, the buzz is different. It’s the hum of high-torque servo motors and the whir of cooling fans for edge-computing modules.

Shenzhen is no longer just assembling the world’s devices; it is giving them autonomy.

For this Product Focus Deep Dive, we are moving past the press releases to dismantle the “Shenzhen Embodied AI” ecosystem. We will compare the technical specifications of leading humanoids, expose the domestic supply chain that makes them 50% cheaper than their Western counterparts, and analyze the “20+8” policy framework that is fueling this fire.

This is not just about robots; it is about the next phase of global manufacturing.

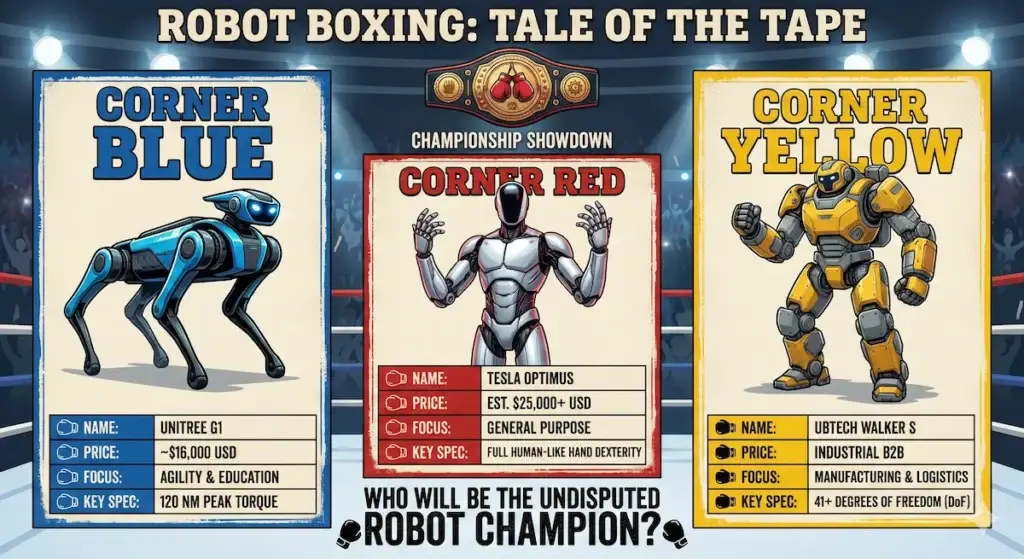

Part 1: The Specs War (Shenzhen AI Robotics vs. The World)

The global narrative often pits Tesla’s Optimus against Boston Dynamics’ Atlas. But in the factories of the Pearl River Delta, the real competition is domestic, fierce, and incredibly fast. Let’s look at the hardware currently being deployed.

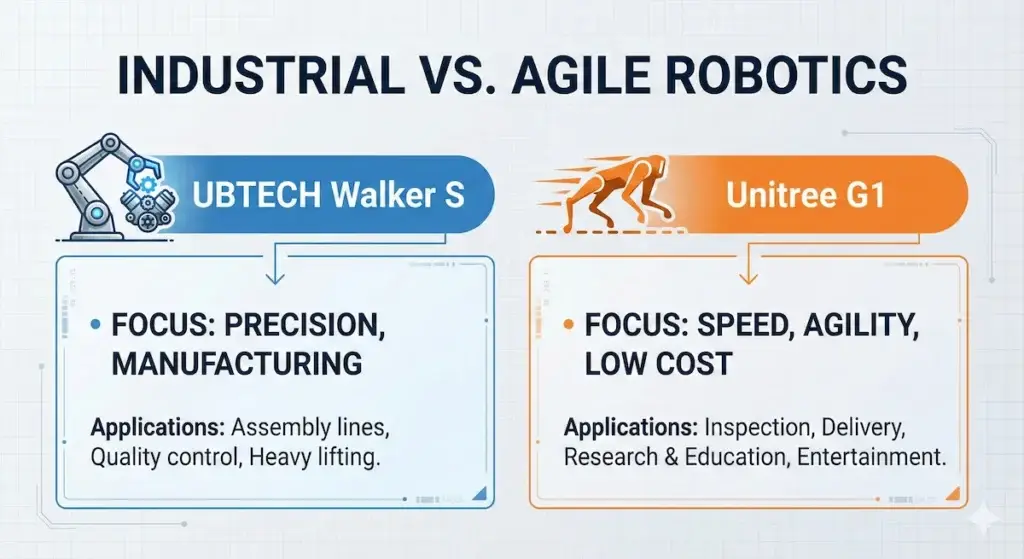

1. UBTECH Walker S: The Factory Specialist

While many robots are designed for YouTube, the Walker S is designed for the assembly line. In late 2024 and throughout 2025, UBTECH began pilot programs with major EV manufacturers (including NIO), effectively treating the robot as a “plug-and-play” worker.

- Height/Weight: 170cm / 75kg (Approx. human proportions).

- Degrees of Freedom (DoF): 41+ servo joints. This high number is critical. It allows for “force feedback” manipulation, meaning the robot can “feel” if a screw is cross-threaded or if a car badge is misaligned [1].

- Visual Servoing: Unlike older robots that followed pre-programmed paths, the Walker S uses RGBD (Red Green Blue Depth) sensors to adjust its movements in real-time. If a conveyor belt jitters, the robot’s hand adjusts instantly.

- The Killer Feature: It is electric, not hydraulic. This reduces maintenance costs drastically, a key requirement for 24/7 factory operations.

2. Unitree G1 & H1: The Cost Disruptors

If UBTECH is the “Apple” (polished, expensive, closed ecosystem), Unitree is the “Android” (accessible, varied, rapid iteration).

- The Unitree G1: Priced aggressively (starting around $16,000 USD), the G1 is the democratization of humanoid robotics.

- Torque Density: The G1 features knee joint torque of roughly 120 N.m. While less than a heavy industrial arm, it is sufficient for walking, crouching, and carrying light loads (2-3kg per arm) [2].

- Dexterity: The G1 utilizes a three-finger force-controlled hand, giving it a distinct advantage over Tesla Optimus’s early grippers for fine motor tasks like cracking walnuts or soldering wires [3].

- The Unitree H1: This is the heavyweight champion, holding world speed records for humanoid running (3.3 m/s). It uses 360-degree LiDAR (supplied by Shenzhen’s own RoboSense) to map environments instantly.

Part 2: Anatomy of a Shenzhen Robot (The Supply Chain)

For sourcing professionals and investors, this is the most critical section. Why can Shenzhen build a robot for $20,000 that costs a US startup $100,000 to prototype? The answer lies in the vertical integration of the component stack.

1. The Joints: Harmonic Drives

The “muscle” of a robot is its actuator. Historically, this market was dominated by Japanese giants (Harmonic Drive Systems). Today, Shenzhen-based Leaderdrive (Leader Harmonious Drive Systems) controls over 60% of the domestic market [4].

- The Impact: By sourcing locally, Shenzhen robotics firms cut the cost of their most expensive component by 40-50% compared to competitors relying on imported Japanese gears.

2. The Eyes: LiDAR and Vision

Self-driving cars drove the cost of LiDAR down, and Shenzhen’s RoboSense and Hesai were the beneficiaries.

- Innovation: These companies moved from expensive mechanical spinning LiDARs to “Solid-State LiDARs.”

- Application: A Unitree robot doesn’t need a $5,000 sensor package. It uses a domestic solid-state unit that costs a fraction of that, allowing for full 3D SLAM (Simultaneous Localization and Mapping) without breaking the BoM (Bill of Materials) [5].

3. The Brains: Edge Compute

This is where the trade war hits home (more on that in Part 4). Most Shenzhen robots utilize NVIDIA Orin modules or domestic alternatives (like Horizon Robotics chips) for on-device processing. The ability to source these PCBs and integrate them within hours—not weeks—is the “Shenzhen Speed” advantage.

Part 3: The “20+8” Policy Engine

The explosion of Shenzhen AI Robotics isn’t an accident; it is a “Planned Industrial Cluster.” The Shenzhen government’s “20+8” Policy (targeting 20 strategic emerging industries and 8 future industries) specifically earmarks robotics as a priority [6].

The “Living Lab” Concept

The most unique aspect of Shenzhen’s policy is “Scenario Opening.”

- What it means: The government explicitly opens public services to AI testing.

- Examples: You will see autonomous street sweepers in Futian District and delivery robots in university towns. These aren’t rogue tests; they are government-sanctioned data gathering exercises.

- Subsidy Structure: The Shenzhen Artificial Intelligence Industry Association (SAIIA) notes that qualified “Intelligent Computing Platforms” can receive subsidies of up to 20 million RMB (approx. $2.7M USD), while enterprises can access “Computing Vouchers” worth up to 6 million RMB annually to offset the cost of training their AI models [7].

Part 4: The Chip War and Geopolitics

We cannot discuss Chinese AI without addressing the elephant in the room: US Export Controls.

With restrictions on high-end NVIDIA training chips (like the H100 and Blackwell series), how is Shenzhen AI Robotics keeping up?

- Efficiency over Brute Force: Denied access to the massive clusters used by OpenAI, Shenzhen firms are optimizing for “Edge Inference.” They train smaller, domain-specific models (e.g., a model just for welding) rather than massive General Purpose models.

- The Rise of Huawei Ascend: Though often unspoken in press releases, the ecosystem is quietly shifting toward domestic compute stacks like Huawei’s Ascend 910B for training, ensuring that the industry is “sanction-proof” in the long term.

- The Stockpile Reality: Many firms anticipated the 2025 tightening of restrictions and aggressively stockpiled compute resources in 2023-2024.

“The US bans slowed them down for six months. But they forced the ecosystem to become self-reliant. In the long run, that might be the most dangerous outcome for Western tech dominance.” — Global Supply Chain Analyst.

Part 5: The Economic Reality (2026 and Beyond)

As we look toward 2026, the year analysts are calling the “Year of Mass Production” (or Yangsan), the economics are terrifyingly compelling.

- The Cost Equation: A Unitree G1 costs roughly $5.71 per operating hour (amortized).

- The Comparison: A US warehouse worker averages $28.00 per hour (wages + benefits) [8].

This 5x delta is the margin that will drive adoption. It is not about replacing all humans; it is about “Augmentation.” The future Shenzhen factory will likely see teams of 10 robots managed by 1 highly skilled human engineer—a role that pays significantly better than the assembly jobs of the past.

Conclusion: The Product is the Process

For the readers of Liberty Trade Chronicles tracking the Shenzhen AI Robotics, the takeaway is clear. If you are sourcing consumer electronics, Shenzhen is still the place. But if you are looking for productivity solutions, Shenzhen has evolved.

The robots are coming. They are affordable, they are battle-tested in the world’s harshest manufacturing environments, and they are available for export. The question for your business in 2026 is not “Can we afford a robot?” but “Can we afford to compete against competitors who have them?”

References & Further Reading

- UBTECH Robotics Official Specs & NIO Partnership Announcement (2024-2025).

- Unitree Robotics, “G1 Humanoid Agent Technical Whitepaper,” May 2024.

- Robozaps, “Tesla Optimus vs. Unitree G1: The Ultimate Comparison,” 2025.

- Leaderdrive (Leader Harmonious Drive Systems), “2024 Annual Report & Market Share Analysis.”

- MarketsandMarkets, “Solid-State LiDAR Market Global Forecast to 2030,” emphasizing RoboSense and Hesai market leadership.

- Shenzhen Municipal People’s Government, “Action Plan for Cultivating Development of Future Industry Clusters (20+8 Policy).”

- Shenzhen Artificial Intelligence Industry Association (SAIIA), “2025 AI Development White Paper.”

- Maeil Business Newspaper (MK.co.kr), “Humanoid Robot Cost Analysis: $5.71 vs $28,” Dec 31, 2025.

Appendix: The Shenzhen AI Robotics Sourcing Cheat Sheet

For procurement managers and R&D teams, here is the direct contact list for the key suppliers mentioned in this deep dive.

(Copy and paste the table below directly into your WordPress block editor)

| Company | Category | Key Product Lines | Official Website |

| UBTECH Robotics | Humanoid / Industrial | Walker S (Industrial Humanoid), Cruzr (Service), ADIBOT (Disinfection) | ubtrobot.com |

| Unitree Robotics | Humanoid / Quadruped | G1 (Education/Research Humanoid), H1 (Full-size), Go2 (Quadruped Dog) | unitree.com |

| Hai Robotics | Logistics / Warehousing | HaiPick System (ACR – Autonomous Case-handling Robots), A42 Series | hairobotics.com |

| Dorabot | Logistics / Sorting | DoraSorter (AI Sorting Arm), DoraPalletizer (Heavy Duty) | dorabot.com |

| Leaderdrive | Components (Actuators) | Harmonic Drives (Strain Wave Gears), Rotary Actuators (Joint Modules) | leaderdrive.com |

| RoboSense | Components (Sensors) | M-Series (MEMS LiDAR), E-Series (Flash Solid-State LiDAR) | robosense.ai |

| Hesai Technology | Components (Sensors) | AT128 (Long Range LiDAR), XT Series (High Precision for Robotics) | hesaitech.com |

| Standard Robots | Industrial AMRs | Oasis Series (Lifting AMRs), Gulf Series (Smart Forklifts) | standard-robots.com |