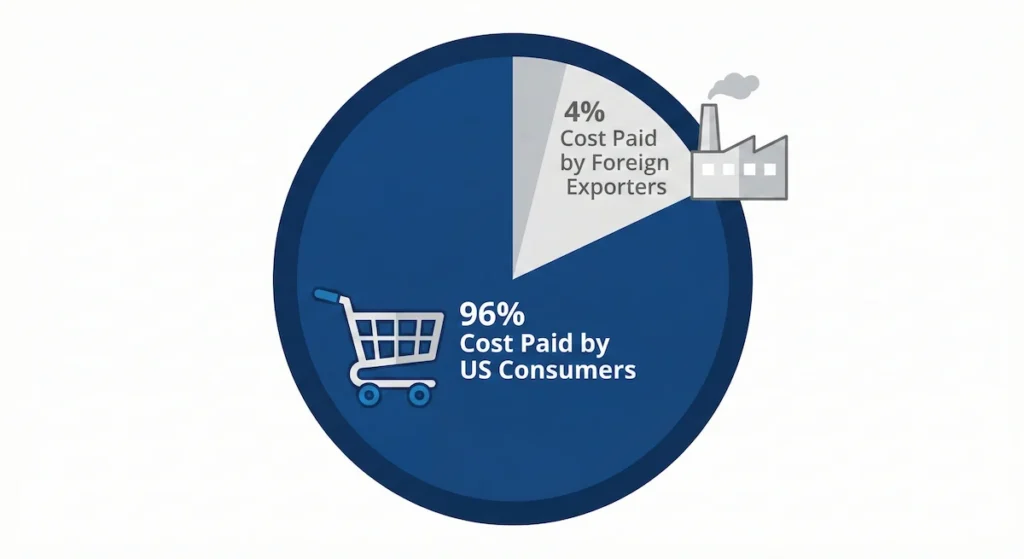

A groundbreaking new study on the US tariff burden has settled a long-standing economic debate, revealing that 96% of the costs are borne by American consumers rather than foreign exporters. Released this week by the Kiel Institute for the World Economy, the findings challenge political narratives by showing that domestic importers and households are footing nearly the entire bill for recent trade levies.

While tariffs are frequently pitched to the public as a tool to extract revenue from foreign competitors, the economic reality is proving to be starkly different. According to the data, foreign exporters are absorbing only a tiny fraction of the costs, leaving the US economy to handle the rest (Kiel Institute, 2026).

The 96% vs. 4% Split: What the Data Says

The study, titled “America’s Own Goal: Who Pays the Tariffs?”, offers one of the most comprehensive analyses of trade data to date. Researchers examined over 25 million shipment records valued at approximately $4 trillion covering the period from January 2024 to November 2025 (Global Times, 2026).

The objective was to see if foreign companies lowered their prices to stay competitive in the US market. The data shows they did not.

The results were unambiguous:

- Foreign Exporters: Absorbed only 4% of the tariff costs.

- US Importers & Consumers: Shouldered the remaining 96% through higher purchase prices.

Julian Hinz, Research Director at the Kiel Institute, was blunt about the implications: “The claim that foreign countries pay these tariffs is a myth. The data show the opposite: Americans are footing the bill” (Kiel Institute, 2026).

Why Foreign Exporters Are Not Lowering Prices

One of the study’s most critical insights is why this burden shift is happening. Theoretically, a foreign company might lower its selling price to offset the tariff and keep its US market share. However, the study found this rarely happens in practice.

Exporters often operate on thin margins and cannot afford to absorb a 10% or 20% tax. Furthermore, many of these exporters have alternative global markets for their goods. If the US market becomes too costly due to tariffs, they simply divert shipments elsewhere rather than cutting prices. This leaves US importers with no choice but to pay the tariff-inflated price or face shortages (Kiel Institute, 2026).

Economic Impact: Competitiveness and Costs

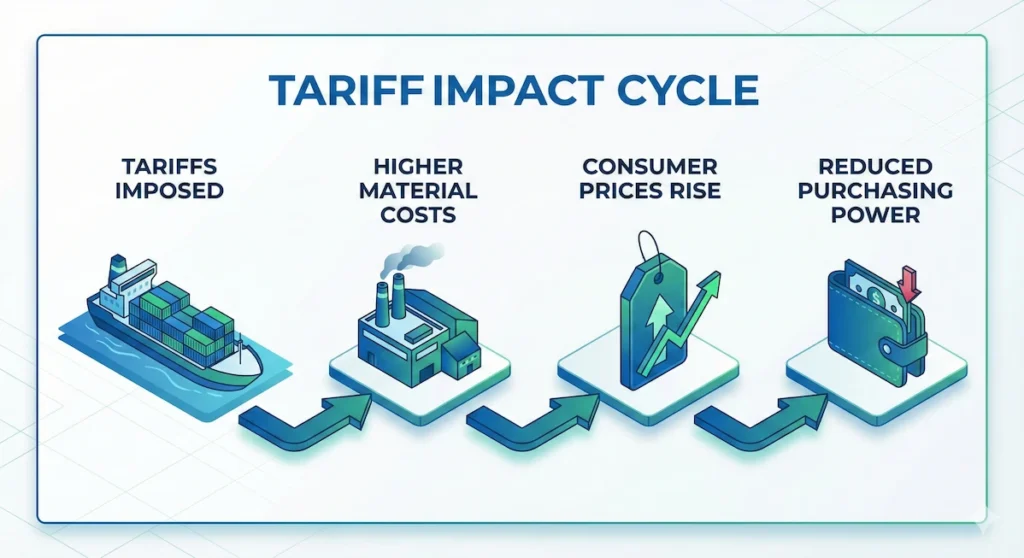

While the tariffs have generated significant government revenue—US customs reportedly collected nearly $200 billion in 2025—economists characterize this not as “profit” from abroad, but as a direct transfer from American wallets to the US Treasury.

Effectively, this acts as a consumption tax. When importers face higher levies, they pass those costs down the supply chain. By the time a product reaches the retail shelf, the price tag has ballooned, directly eroding the purchasing power of American families (Global Times, 2026).

Weakening Industrial Competitiveness

The burden isn’t just on shoppers; it hits American manufacturers hard. The Global Times notes that US industries relying on imported raw materials or intermediate goods now face significantly higher production costs. This inflation in input costs makes final US-manufactured goods more expensive, thereby “weakening industrial competitiveness” in the global marketplace (Global Times, 2026).

Reduction in Variety

Beyond price hikes, the study found that the variety of goods available to US consumers has declined. As importing certain items became financially unviable, many foreign suppliers simply stopped shipping them, reducing market choice (Kiel Institute, 2026).

Case Studies: The Resilience of Exporters

To verify their findings, the researchers conducted specific “event studies” on tariff hikes imposed on Brazil and India in August 2025.

- Brazil: Despite sharp tariff increases, Brazilian exporters did not lower their prices to absorb the cost.

- India: When tariffs on specific Indian goods jumped from 25% to 50%, exporters maintained their pricing. The result was a drop in shipment volume, but the unit price paid by Americans remained high (Kiel Institute, 2026).

The Verdict

The report concludes that while tariffs are often framed as a protective measure, the economic reality is that they function as an “own goal.” By raising domestic prices and stifling industrial efficiency, the policy places the weight of trade wars squarely on the shoulders of the American public (Global Times, 2026).