Introduction

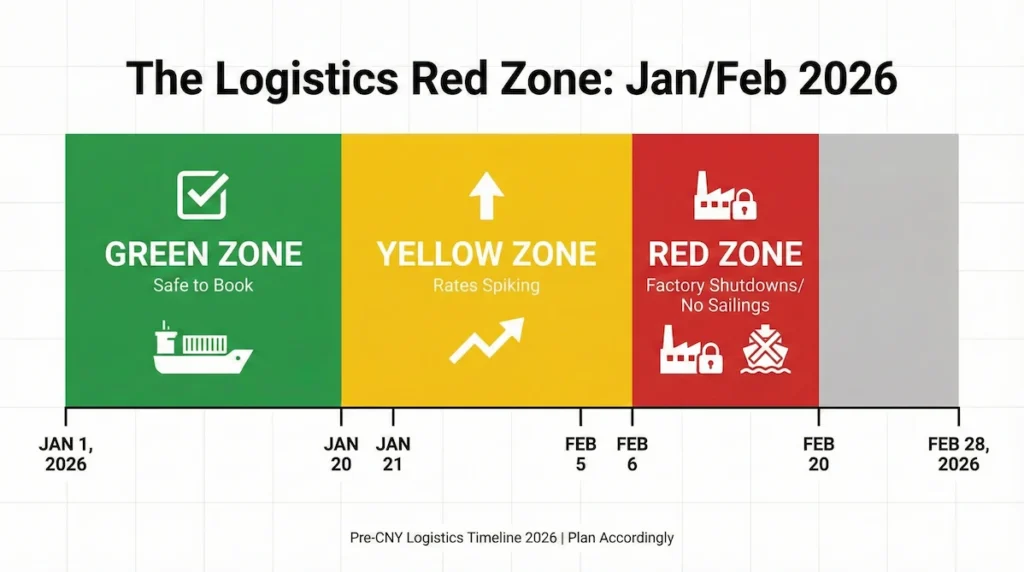

Welcome to the first Jan 2026 Market Watch on Liberty Trade Chronicles. If you are moving goods out of Asia, the theme for January is “Urgency.” While current spot rates feel deceptively soft, the data signals a sharp pivot coming in the final weeks of this month.

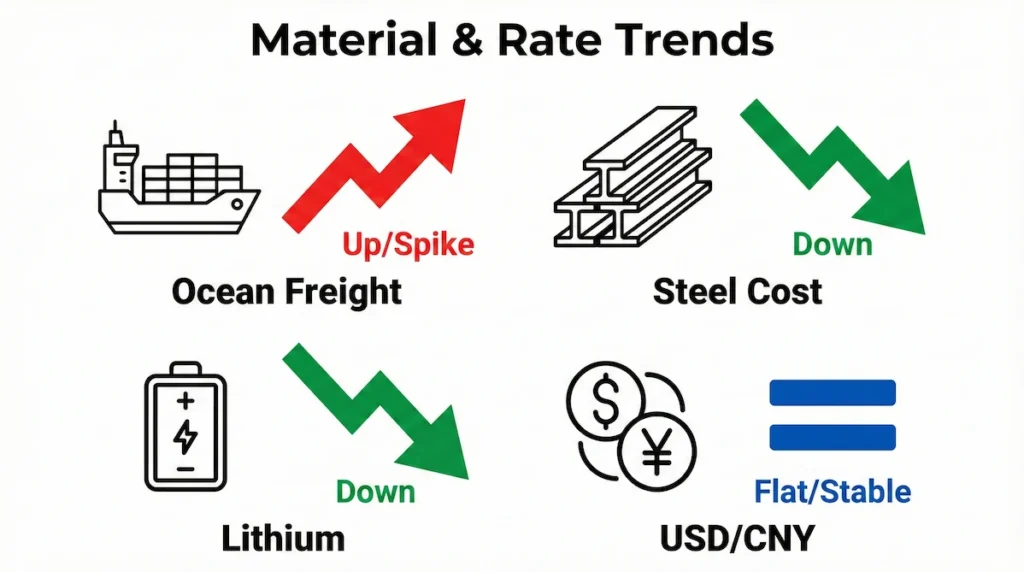

With Chinese New Year (CNY) landing on February 17, 2026, the traditional “pre-holiday rush” is condensing into a tight 3-week window starting late January. Simultaneously, raw material inputs like Lithium and Steel are showing bearish trends, offering a buying opportunity for manufacturers.

Here is your executive summary of the rates, dates, and data that matter this month.

1. Jan 2026 Market Watch: The Pre-CNY Sprint

The window to lock in favorable rates is closing. Carriers are preparing to blank sailings (cancel voyages) to artificially tighten capacity ahead of the February holidays.

- Ocean Freight (China → US/Europe):

- Status: Soft but Volatile.

- The Trend: Spot rates are currently sitting at 2023 lows ($1,850–$2,300 per 40ft to US West Coast), but analysts forecast a 15–30% spike starting January 20th.

- Action: Book now. If you have orders ready, get them on the water before January 25. Cargo bookings after this date will likely face “Peak Season Surcharges” (PSS) and rollover risks.

- The “Blank Sailing” Strategy Explained You might ask: Why are rates spiking if demand is soft? The answer lies in “Blank Sailings.” In anticipation of the CNY shutdown, major carrier alliances are strategically cancelling voyages to artificially reduce supply. By removing capacity from the trans-Pacific lane, they can force spot rates higher even without a surge in cargo volume. For you, this means “confirmed” bookings can suddenly be rolled to the next vessel. Pro Tip: Ensure your freight forwarder has a “No Roll” guarantee clause for your critical pre-CNY shipments, even if it costs a premium.

- Air Freight:

- Status: Moderate Increase.

- The Trend: Rates to the EU and US are seeing mid-single-digit increases. Demand is resilient but not overwhelming.

- Action: Use air freight strictly for emergency stock. The sea-air difference is currently at its widest in months, making ocean freight far more economical if you have the lead time.

2. Raw Material Tracker

For those negotiating with suppliers in China, knowing the input costs gives you leverage.

- Steel & Iron Ore: 📉 Bearish

- Chinese steel rebar prices have held their decline into 2026 ($3,100 CNY/tonne range). Construction demand in China remains muted.

- Negotiation Tip: If you are sourcing machinery, hardware, or building materials, resist price increases. The raw material data does not support a hike.

- Lithium: 📉 Bearish

- Supply from Africa and China has pushed prices down. The “white gold” is currently affordable, making this a prime time to negotiate contracts for battery packs or power banks.

- Oil (WTI Crude): 📉 Stable/Low

- Trading around $59/barrel. Logistics fuel surcharges (BAF) should remain stable or decrease slightly.

3. Jan 2026 Market Watch: Currency Corner (USD vs. CNY)

- Current Rate: 1 USD ≈ 6.99 – 7.00 CNY

- The Outlook: The Yuan is trading in a tight band. It is relatively weak compared to historical highs, which is favorable for USD-based buyers.

- Strategy: With the exchange rate hovering near 7.0, your USD purchasing power is strong. However, avoid spot transfers if it dips below 6.90.

Sector Spotlight: Who is Affected Most?

Our Jan 2026 Market Watch data shows not every industry feels the January pinch equally. Here is how the current data impacts specific sectors:

- Electronics: With lithium prices down, your BOM (Bill of Materials) cost is lower, but you face the highest risk for air freight delays. High-value components are often shifted to air cargo to meet Q1 launch deadlines, crowding out standard shipments.

- Furniture & Home Goods: You are the most vulnerable to the Ocean Freight spike. Since your goods are high-volume but lower margin, a $500 increase in container rates eats significantly into your Q1 profit. We strongly advise postponing non-urgent bulky shipments until late February when rates traditionally cool off.

- Textiles: The “fast fashion” cycle for Spring/Summer collections is creating a bottleneck in consolidation warehouses in Ningbo and Shanghai. Expect LCL (Less than Container Load) processing times to stretch from 3 days to 7 days

4. The “Red Zone” Dates

Mark these dates in your calendar to avoid logistical headaches.

- Jan 20: Ocean freight rates expected to spike.

- Jan 25: “Cut-off” for guaranteed pre-CNY sailing.

- Feb 10: Factories begin to wind down operations/release workers.

- Feb 17: Chinese New Year (Year of the Horse). Complete shutdown.

Conclusion

January 2026 is a buyer’s market, but only for the swift. The combination of low material costs (steel/lithium) and currently soft freight rates creates a “sweet spot” for procurement, but the clock is ticking. Once the pre-CNY rush hits in late January, that window slams shut.

To navigate the volatility highlighted in this Jan 2026 Market Watch, execute this 3-step plan:

- Audit your POs: Identify any orders that must arrive before March.

- Book this week: Secure shipping slots for those critical orders before Jan 10 to avoid the “Jan 20 Rate Spike.”

- Negotiate hard: Use the bearish steel and lithium data to push back on any supplier price increase requests.

The market is calm right now, but the storm is visible on the horizon. Move fast, stay data-driven, and lock in your margins.

Our advice? Finalize your Purchase Orders (POs) this week and secure your shipping slots immediately.

Stay tuned for our next update. This concludes the Jan 2026 Market Watch.