Mexico Tariffs 2026 are no longer a rumor—they are a reality that will hit your bottom line in less than two weeks. If you are reading this from your sourcing office in China or your logistics hub in Los Angeles, you likely felt the ground shift this week with the latest announcement.

For the past two years, the “China-to-Mexico-to-USA” route (often called the USMCA backdoor) has been the worst-kept secret in international trade. But as of yesterday, December 18, 2025, that door has been slammed shut.

As an exporter based here in Hong Kong, I deal with the daily reality of moving goods from Shantou (Toys), Foshan (Furniture), and Ningbo (Appliances) to the West. The headlines hitting my desk this morning aren’t just “updates”—they are existential threats to the low-margin export model.

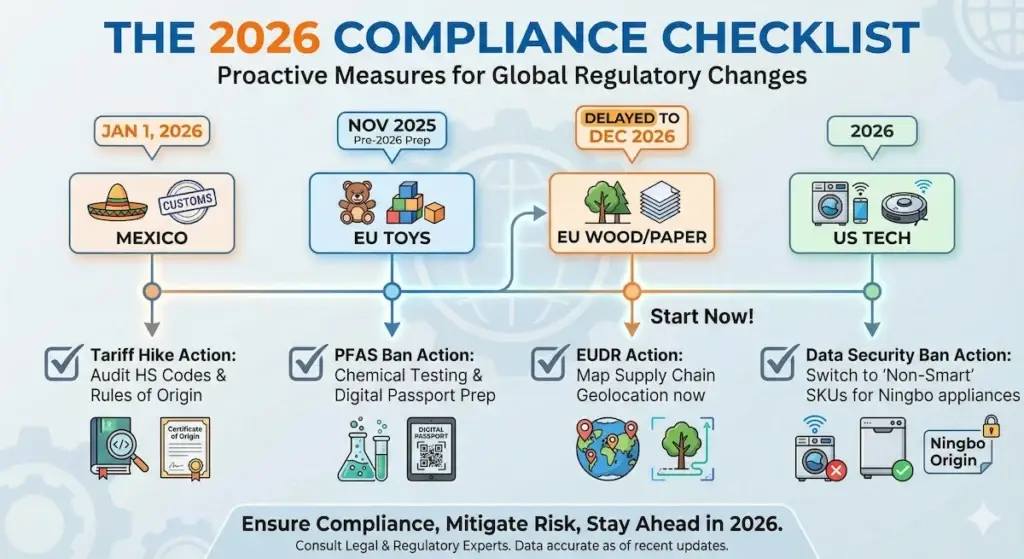

We are facing a “Triple Squeeze” entering 2026: Mexico’s Tariff Wall, the EU’s new Chemical Bans, and the Corporate ESG crackdown. Here is the deep dive on what just happened and how we survive Q1 2026.

1. Mexico Tariffs 2026: The New 50% “Stop-Gap” Duty

The rumor mill has been churning for months, but the Mexican Senate finally pulled the trigger. On December 10, 2025, Mexico approved amendments to its General Import and Export Tax Law, and yesterday we got confirmation of the implementation date: January 1, 2026.

The Hard Numbers:

- Tariff Hike: The Mexico Tariffs 2026 policy mandates duties jumping to 35% – 50% on imports from countries without a Free Trade Agreement.

- Targeted Nations: This is squarely aimed at China, India, Vietnam, and other Asian manufacturing hubs.

- Affected Categories: The list covers 544+ tariff lines, including:

- Furniture (Foshan’s core export)

- Toys (Shantou’s lifeline)

- Steel & Aluminum

- Textiles & Footwear

The “One Stop” Reality: If you have containers of flat-pack furniture currently on the water to Manzanillo intended for transshipment to Texas, your landed cost just increased by half. The “Nearshoring” dream of simply assembling Chinese parts in Monterrey is now financially toxic unless you can prove significant regional value content to qualify for USMCA—a bar that is getting higher by the day as the 2026 USMCA joint review approaches.

Key Takeaway: Stop quoting DDP (Delivered Duty Paid) Mexico immediately. Review all HS codes for “essential transformation” status. If you are just repacking in Mexico, that game is over.

2. Toys (Shantou): The “Forever Chemical” Ban & Digital Passports

While American eyes are on tariffs, the European Union has quietly revolutionized toy safety. On November 25, 2025, the European Parliament approved the new Toy Safety Regulation, replacing the old 2009 directive.

The “PFAS” Trap: For my supplier friends in Chenghai (Shantou), the headache isn’t lead paint anymore; it’s PFAS (Per- and Polyfluoroalkyl Substances).

- The Ban: The new regulation bans “forever chemicals” (used in water-resistant fabrics for dolls, stain-resistant coatings, etc.) and endocrine disruptors.

- The Impact: If you export plastic toys, plush dolls with treated fabrics, or slime/putty products, you need new lab tests now.

The Digital Product Passport (DPP): By late 2027, every toy sold in the EU will need a Digital Product Passport. This is a QR code that reveals the chemical composition and supply chain journey of the product.

- The Immediate Risk: While the DPP doesn’t kick in fully until 2027, major EU retailers (like Carrefour and Lidl) are already demanding this data for their 2026 buy cycles. If your factory in Shantou runs on cash and handshake deals with no paper trail, you will be delisted.

3. Hotel Furniture: The “Green” Reprieve & The Corporate Squeeze

Finally, some “good” news—with a catch.

The EUDR Delay (The Reprieve): As of this week (Dec 17, 2025), the EU officially delayed the Deforestation Regulation (EUDR) by 12 months.

- New Deadline: Large companies now have until December 30, 2026 to prove their wood, rubber, and cattle products come from deforestation-free land.

- Why it Matters: This saves thousands of shipments of wooden furniture and packaging that were at risk of being seized next month. We have one year of breathing room to sort out our geolocation data.

The Corporate Squeeze (The Catch): Don’t celebrate yet. While the EU paused, the brands did not. I export FF&E (Furniture, Fixtures, and Equipment) to Marriott, Hilton, and IHG.

- Marriott’s 2025 Mandate: Their sustainability goals for 2025 are live. They are requiring MindClick Sustainability Assessment Program (MSAP) scores for all approved vendors.

- The Reality: Even if the EU doesn’t stop your wood at the border, Marriott will stop your invoice if you aren’t “Leader” level certified. I am seeing factories in Foshan losing contracts to Vietnam not because of price, but because the Vietnamese factories have better paperwork for LEED v4.1 compliance.

4. Appliances (Ningbo): The Data Security Tariff

For my home appliance exports from Ningbo, the threat is invisible. The US “Smart Device” restrictions are tightening.

- The Issue: Wi-Fi-enabled kitchen gadgets (Air Fryers, Smart Kettles, Robot Vacuums) are now being scrutinized for “Data Security” risks if they use Chinese cloud servers.

- The 2026 Trend: We are seeing a pivot back to “Dumb Appliances.” American importers are specifically asking for non-connected versions of products to avoid the extra 25% “tech tariff” and potential sales bans.

The “Danger List”: High-Risk HS Codes for Mexico Tariffs 2026

1. Furniture (Foshan Sourcing)

The hardest hit sector. If you export home or hotel furniture, these codes are now subject to maximum duties unless you have a valid Certificate of Origin (USMCA).

- HS 9401.61: Upholstered seats with wooden frames (Hotel armchairs, dining chairs).

- HS 9401.71: Upholstered seats with metal frames (Office chairs, banquet chairs).

- HS 9403.30: Wooden furniture of a kind used in offices (Desks, cabinets).

- HS 9403.50: Wooden furniture of a kind used in the bedroom (Bed frames, nightstands).

- HS 9403.60: Other wooden furniture (Living room tables, TV stands).

- HS 9405.10: Chandeliers and other electric ceiling or wall lighting fittings (often bundled with FF&E projects).

2. Toys (Shantou Sourcing)

Mexico is targeting “finished consumer goods” to protect local manufacturing. Tariffs here are jumping to 35-50%.

- HS 9503.00: Tricycles, scooters, pedal cars, and similar wheeled toys; dolls’ carriages; dolls; other toys; reduced-size (“scale”) models and similar recreational models, working or not; puzzles of all kinds.

- Note: This single code covers 90% of Shantou exports. Check specific sub-codes for “Dolls” (9503.00.20) vs “Electric Trains” (9503.00.10).

3. Appliances (Ningbo Sourcing)

- HS 8509.40: Food grinders and mixers; fruit or vegetable juice extractors.

- HS 8516.60: Other ovens; cookers, cooking plates, boiling rings, grillers and roasters (Air Fryers fall here).

- HS 8516.71: Electro-thermic appliances: Coffee or tea makers.

- HS 8418.10: Combined refrigerator-freezers (Mini-fridges often used in hotels).

4. Building Materials & Metals

If you supply construction projects, steel and aluminum are the original targets of this trade war.

- HS 7210.30: Flat-rolled products of iron or non-alloy steel (Galvanized steel sheets).

- HS 7604.10: Aluminum bars, rods, and profiles (Window frames, structural components).

- HS 7318.15: Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter-pins, washers (including spring washers) and similar articles, of iron or steel.

The “Liberty Trade” Verdict for 2026

The Mexico Tariffs 2026 update proves that the era of “send it and forget it” is dead.

In 2026, Compliance is the new Duty-Free.

If you are sourcing from China, your value proposition can no longer just be “cheaper.” It must be “safer.” You need to be the exporter who:

- Knows the HS Code loopholes for Mexico.

- Has the PFAS-free test reports for Europe.

- Can provide the FSC Chain of Custody for the hotel giants.

Trade isn’t stopping; it’s just getting more professional. Those who adapt will own the market. Those who don’t will be stuck in a bonded warehouse in Manzanillo wondering where their margin went.

Pingback: Australia India Zero Tariff Exports: 2026 Guide