The Great Trade Reset is officially upon us. If 2025 was the year of shock—defined by the sudden inauguration of a new US administration and reactionary export curbs—2026 is shaping up to be the year of structural permanence.

For the last twelve months, many in the sourcing community have operated in a state of suspended animation. We held our breath, hoping that the 60% tariff proposals were merely negotiation tactics and that the EU’s green mandates would be watered down at the eleventh hour.

As we stand here in mid-December, the reality has crystallized. The geopolitical friction we viewed as temporary anomalies has hardened into the new operating system of global trade. The era of frictionless, low-tariff globalization is officially behind us.

For sourcing professionals and international traders, the “wait and see” period is over. If you are moving goods across borders today, you are facing a convergence of three seismic shifts. Here is your comprehensive guide to surviving—and thriving—in the Great Trade Reset of 2026.

1. The CBAM Bill Finally Comes Due (And It’s Not Just About Carbon)

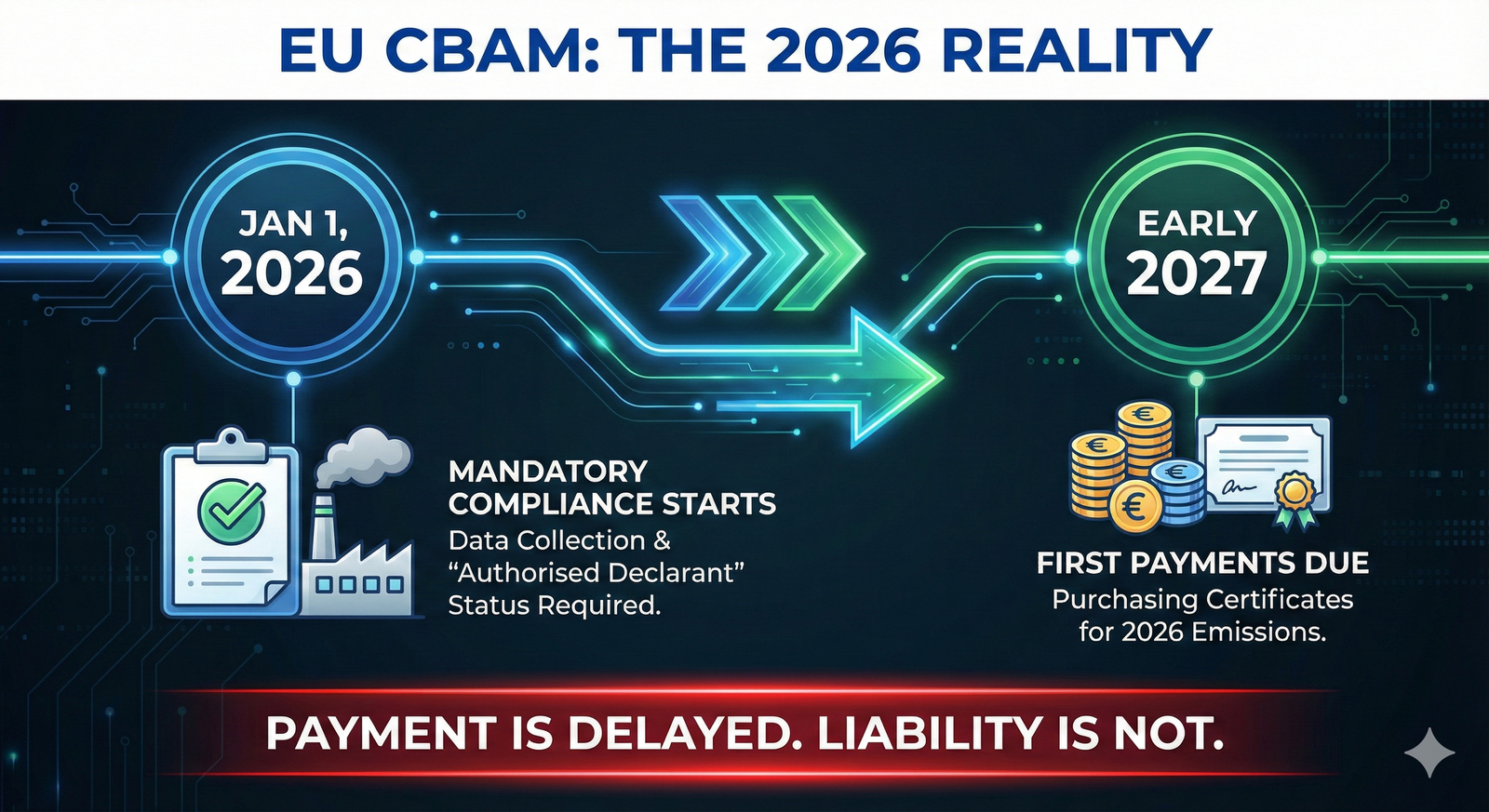

For the past two years (2023–2025), exporters to Europe have lived in the “Transitional Phase” of the Carbon Border Adjustment Mechanism (CBAM). We’ve dealt with the administrative headache of reporting emissions, but our wallets remained largely untouched. This created a false sense of security.

That ends on January 1, 2026.

The “Definitive Regime” officially begins in less than three weeks, marking the first major regulatory milestone of the Great Trade Reset. While recent EU simplifications have postponed the purchase of CBAM certificates (the payment) until 2027, do not misinterpret this as a delay in enforcement.

The Hidden Compliance Trap

The payment delay is a cash-flow relief, not a compliance holiday. The mandatory compliance clock starts immediately.

- Status Requirement: You must be registered as an “Authorised CBAM Declarant” with your National Competent Authority immediately.

- Data Liability: Your emissions data from imports in 2026 will determine your bill in 2027. If you fail to collect accurate data now, you cannot retroactively fix it later.

The “Default Value” Penalty: If your suppliers in Asia have not established a verified carbon reporting methodology, you will be forced to use the EU’s “default values” for embedded emissions. These defaults are punitive—often set at the emissions level of the worst-performing producers in the EU. This could arbitrarily inflate your import costs by 15-20% when the bill finally comes due.

Pro Tip: Focus on the “Big 6” sectors first: Iron/Steel, Aluminum, Cement, Fertilizer, Hydrogen, and Electricity. If you import finished goods like screws or aluminum frames, you are squarely in the crosshairs.

2. The “60% Reality” of US-China Relations

Throughout 2025, we watched the US tariff landscape shift dramatically. The “Trump 2.0” administration’s push for reciprocal tariffs has fundamentally altered the math of trans-Pacific trade. The 60% tariff on Chinese goods is no longer a headline; it is the baseline for your 2026 landed cost models and defining feature of the Great Trade Reset.

This tariff wall has forced a massive acceleration in decoupling, but the response from savvy traders is changing. It’s no longer just about fleeing China; it’s about defensive structuring.

The “Substantial Transformation” Audit

In 2026, the battleground will shift from tariffs to enforcement. US Customs and Border Protection (CBP) is intensifying scrutiny on transshipment.

- The Scenario: A factory moves assembly from Shenzhen to Haiphong, Vietnam. They import 90% of the components from China, assemble them in Vietnam, and label it “Made in Vietnam” to avoid the 60% US duty.

- The Risk: Under intensified enforcement, this does not qualify as “Substantial Transformation.”

If you cannot prove that a distinct new article of commerce was created—with significant value-add occurring outside of China—you face not only the retroactive 60% duty but also massive fines for customs fraud. In 2026, “Country of Origin” will be the single most audited field on your customs declaration.

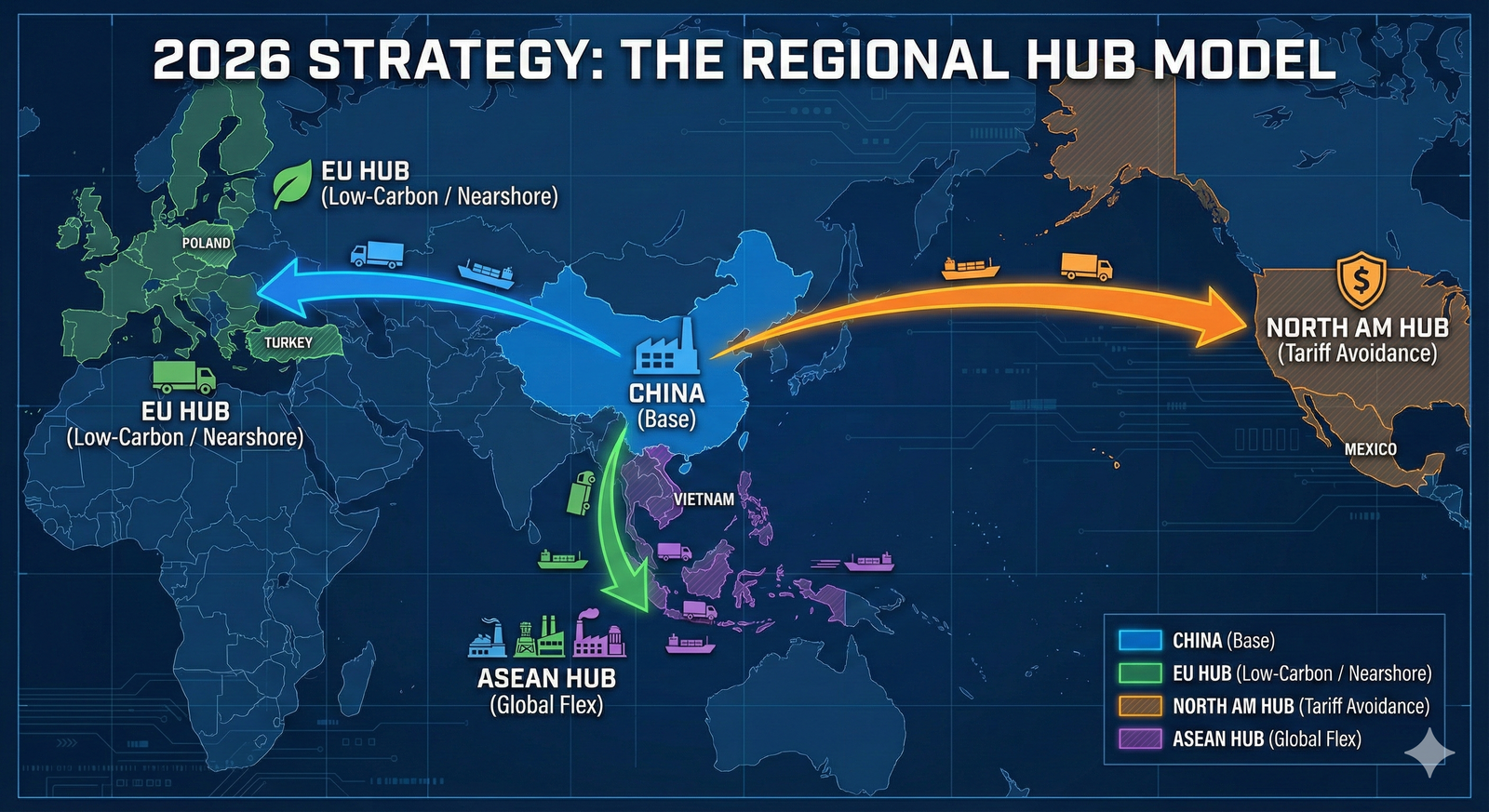

3. “China Plus One” Is Now “China Plus Two”

For a decade, the industry standard was “China Plus One”—keeping the bulk of production in China while opening a satellite facility in Vietnam or India.

In late 2025, that strategy officially broke.

The sheer volume of companies flooding into Vietnam caused infrastructure gridlock, labor shortages, and rising costs – a clear signal that the Great Trade Reset demands more than a single backup plan. Leading logistics providers are now advising a move from “China Plus One” to a multi-region ecosystem.

The most resilient supply chains entering 2026 are adopting a regionalized hub model:

- Eastern Europe & Turkey: For the EU market. This shortens shipping times and, crucially, often aligns better with low-carbon energy grids, helping to mitigate CBAM costs.

- Mexico (Nearshoring): For the North American market. Despite higher labor costs than Asia, the savings on freight and the speed-to-market advantage are proving decisive for US-bound goods.

- ASEAN (The Traditional Hub): Vietnam, Thailand, and Indonesia remain vital for the rest of the world, but they are no longer the only basket for your eggs.

4. The Return of Volatility: Freight and Currency

While regulations dominate the headlines, do not ignore the fundamentals of the Great Trade Reset. The fragmentation of global trade into rival blocs (US-centric vs. China-centric) is wreaking havoc on logistics efficiency.

We are seeing the emergence of a “bifurcated” shipping market. Vessels plying the trans-Pacific route are seeing rate spikes due to lower volumes and higher risks, while intra-Asia trade booms.

Furthermore, the currency wars of late 2025 have left the US Dollar exceptionally strong. While this helps American buying power, it punishes emerging market suppliers who buy their raw materials in dollars. Expect supplier insolvencies in Q1 2026 as smaller factories in Bangladesh or Vietnam struggle with currency mismatches and working capital shortages.

Summary: Surviving the Great Trade Reset of 2026

The era where the “lowest unit price” won the contract is over. In 2026, the cheapest supplier is often the most dangerous one.

If a supplier offers you a rock-bottom price but cannot provide a CBAM carbon certificate, or cannot prove the origin of their cotton to satisfy US forced labor laws (UFLPA), that product is effectively worthless. It cannot cross the border.

The winners in 2026 will be defined by three traits of the Great Trade Reset:

- Visibility: Knowing exactly where Tier 2 and Tier 3 materials come from.

- Agility: The ability to switch between a “Mexico Hub” and an “Asia Hub” depending on tariff fluctuations.

- Compliance: Viewing carbon and labor data as just as important as quality control.

If you haven’t audited your HS codes for new tariff liabilities or checked your supplier’s carbon data sheets this month, make that your priority before the holiday break. The rules have changed; ensure your playbook has too.

[Download: The 2026 Trade Readiness Checklist (PDF)] Ensure your business is protected against these 3 shifts. Click here to download our free 10-point audit for Q1 2026.